FloBiz, an Indian startup that is building a neobank for small- and medium-sized businesses in the South Asian market, said on Monday it has raised $31 million in a new financing round as it works to broaden its product offerings.

Sequoia Capital India and Think Investments co-led the 18-month-old startup’s Series B financing round. Existing investors Elevation Capital and Beenext also participated in the round, which brings FloBiz‘s all-time raise to over $41 million.

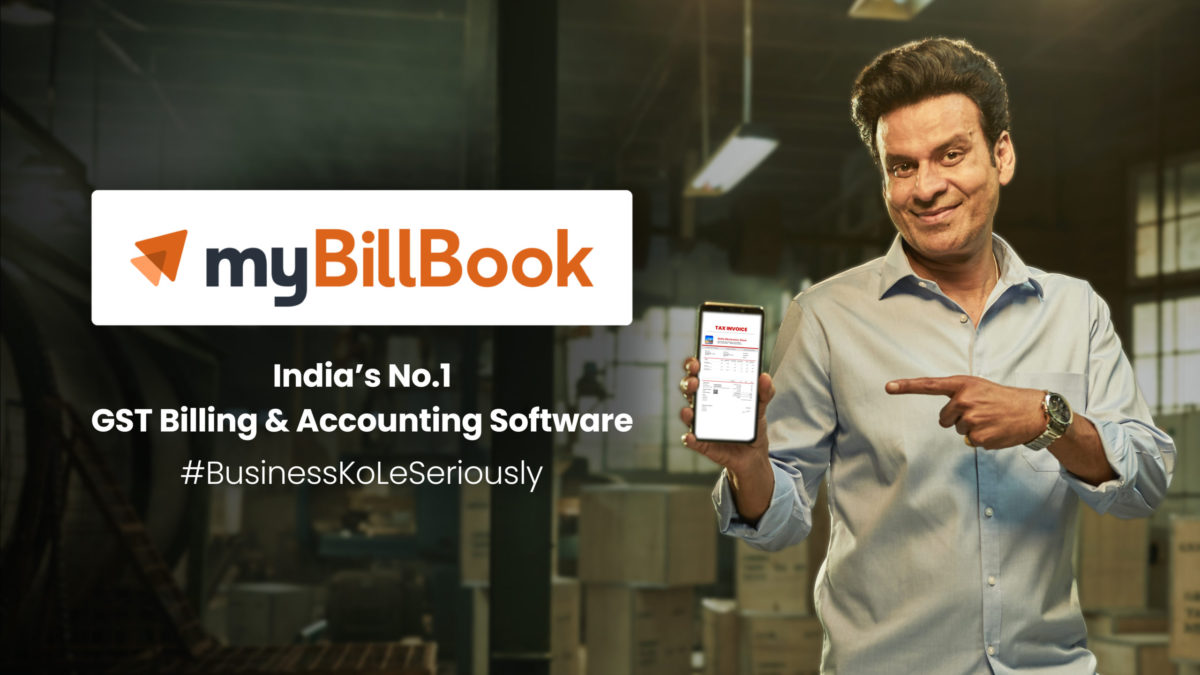

The startup’s marquee offering — called myBillBook — helps small- and medium-sized businesses digitize their invoicing, streamline business accounting, and automate workflows of their enterprises.

India, the world’s second largest internet market, is home to millions of small- and medium-sized businesses. Scores of startups have launched neobanks in the country in recent years to focus on serve millennials or businesses.

“SME-focussed neobanks are building engagement with business- clients through their ability to provide solutions like automated invoicing, collections/payments, accounting, inventory and sales management, taxes and in some cases interest on current deposits as well (banks can’t pay interest). This may help to ramp- up and upfront their monetisation prospects,” analysts at Jefferies wrote in a report to clients last week.

myBillBook, which supports Hindi, Gujarati and Tamil as well as English, will add support for “at least” five more regional languages within the next six months, the startup said, adding that the app has been downloaded over 5 million times.

“The product will also see deeper use of technologies like AI & image processing to make the onboarding process for the less tech-savvy SMB owners in tier 2 and tier 3 cities of India a delightful first step to digital accounting,” the startup said.

Scores of high-profile entrepreneurs — including Vijay Shekhar Sharma of Paytm, Kunal Shah of CRED, Jiten Gupta of Jupiter, Amrish Rau of Pine Labs, Krishnan Menon of BukuKas, and Nitin Gupta of Uni Cards — have also backed FloBiz in the new financing round.

“Small businesses are the real heroes of our economy. In order to power the SMB economy with technology, one needs deep understanding, instinct and empathy for this audience,” said Tejeshwi Sharma, Managing Director of Sequoia Capital India, in a statement.

“We are really impressed by the user centricity, product focus and experimentative approach of the FloBiz founders. There is almost a perfect founder market fit. The team is stoked to partner with FloBiz on their mission of building a neobank for the growing SMBs of India.”

Rahul Raj, co-founder and chief executive of FloBiz, said the startup will deploy the fresh capital to “accelerate projects which have been in the works up till now – building personalisable modules & features into myBillBook, diversifying core product offerings and preparing to roll out financial services. We have a slew of developments in the pipeline to further delight our SMB partners in the next 12 months.”

This story was first published by TechCrunch.